tax liens in georgia list

When the lien is issued the county or town that is owed property taxes creates a tax-lien certificate that includes the amount of the taxes owed plus interest and penalties. Under existing law in Georgia a redeeming party simply by virtue of redeeming is entitled to first position against excess tax-sale funds.

Have A Delinquent Property Tax List And Want To Sell One

Non-judicial and judicial tax sales.

. 41 2003 which involved competing lien holders in the context of a tax sale. This tool allows for searching for state tax liens and related documents that have been submitted by the Georgia Department of Revenue for subsequent acceptance and filing by a clerk of superior court. Georgia does not have an Export List.

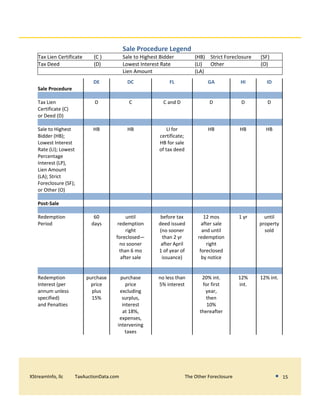

Everyone loves them for good reason they can be very lucrative. In Georgia there are two types of tax lien sales. The County files a lien and then auctions off a deed.

Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am. This is the searchable electronic filing submission docket as provided for by Georgia Code 15-6-973 and is effective January 1 2018. Augusta - Richmond County Tax Commissioner.

Property tax liens are used on any type of property whether its land your house or commercial property. Real Estate gurus make big money selling how-to convincing people to invest in them. Select a county below and start searching.

Georgia Tax Lien Homes. A tax sale is the sale of a Tax Lien by a governmental entity for unpaid property taxes by the propertys owner. 11 248 03 020.

Georgia 33531 4 Quarterly Hawaii 4318315 468 Quarterly Idaho 411229 15 plus 25 stamping fee Annually Illinois 215 ILCS 5445 See procedure manual for applying Fire Marshal Tax 35 plus 1 Fire Marshal Tax on Fire lines adjusted by Line plus. Georgia does have an industrial insured exemption with respect to captive insurers only see Appendix C but otherwise recognizes the exempt commercial policyholder. Call our office at 706-821-2391 for current tax sale lists.

Found inside Page 262Salesperson listing two houses on the same street 15. Georgia does not maintain a list of eligible surplus lines insurers. Phone 706821-2391 Fax 706821-2419.

You can potentially hit the jackpot with a minimal investment in a tax lien resulting in you becoming the property owner. A tax lien is a claim or encumbrance placed on a property that authorizes the Tax Commissioner or the Sheriff to take whatever action is necessary and. Georgia does have a Surplus Lines Association see Other Comments section 2.

There are currently 903 tax lien-related investment opportunities in Augusta GA including tax lien foreclosure properties that are either available for sale or worth pursuing. Before you consider tax liens find out what the guidelines are in your specific state and attend an auction to get a feel of the process. Search all the latest Georgia tax liens available.

Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business. Buying tax liens at auctions direct or at other sales can turn out to be awesome investments. The tax lien lists are emailed within one business day of placing an order and are available in a variety of formats.

Avondale Estates tax liens. The original owners may redeem the property. Contact Our Real Estate Team.

6758 BROWNS MILL LAKE RD. A tax lien also known as a FiFa from the Latin term Fieri Facias may also be referred to as a tax execution. College Park tax liens.

Check your Georgia tax liens rules. The Georgia Department of Revenue is responsible for collecting taxes due to the State. You may contact the Statesboro Herald at 912 764-9031.

If you have additional questions about Georgias property tax ownership or tax lien laws please reach out to Brian M. Tax sale where delinquent taxpayer has the ability to redeem hisher property within 12 months of tax sale by paying what the successful bidder paid includes taxes interest penalties legal costsfees plus a 20 premium. North Decatur tax liens.

Tax liens offer many opportunities for you to earn above average returns on your investment dollars. Non-Judicial Tax Sale Info. Once the lien has been issued the lien is submitted to the sheriffs department and.

There are more than 10367 tax liens currently on the market. You can make a one-time list purchase or decide to receive tax lien lists regularly as they are collected. Douglas Associates at 770 933-9009 or via our online contact page.

Tax lien auctions are conducted on the steps of the county courthouse the first Tuesday of the month. 530 Greene St Suite 117 Augusta GA 30901. Tax lien investing can be a good way to see a 12 to 18 percent return on your investment but it is not without heavy competition and some degree of risk.

North Atlanta tax liens. The Department is dedicated to enforcing the tax laws and strives to be fair consistent and reasonable in its actions while collecting delinquent debt. East Point tax liens.

A County in Georgia is owed property taxes that go unpaid. The pitch is simple. This arose out of an often-cited case National Tax Funding vs.

Harpagon held that following a tax sale a competing lien holder had. Just remember each state has its own bidding process. Our tax lien lists are used in a variety of industries such as tax resolution credit repair debt negotiation and much more.

View Augusta - Richmond County information about tax levy sales including list of properties. Our real estate team would be happy to help.

Tax Lien And Tax Deed Investments Exec Summary

Texas Tax Sales Explained Tax Liens Tax Deeds A Goldmine For Real Estate Investors Youtube

How To Buy Tax Lien Certificates In Georgia For Big Profits Tax Lien Certificates And Tax Deed Authority Ted Thomas

97 Properties To Be Sold In Tax And Sheriff S Sale In September Wslm Radio

Tax Lien And Tax Deed Investments Exec Summary

Tax Sale Lists Richmond County Tax Commissioners Ga

Chattooga County March 2021 Tax Sale Allongeorgia

Delinquent Tax Sale Nets Over 10 000 For Properties Sold At Courthouse

Georgia Real Estate Tax Lien Investing For Beginners Secrets To Find Finance Buying Tax Deed Tax Lien Properties 9781951929091 Blank Greene Mahoney Brian Books Amazon Com

Earn Interest By Investing In Tax Liens In Sprout Residential Fund Mortgage Interest Rates Mortgage Rates Online Mortgage

Amazon Com How To Buy State Tax Lien Properties In Georgia Real Estate Get Tax Lien Certificates Tax Lien And Deed Homes For Sale In Georgia Ebook Mahoney Brian Kindle Store

Complete List Of Tax Deed States Tax Lien Certificates And Tax Deed Authority Ted Thomas

Tax Lien Certificates Directory Featuring States That Allow Investing In Tax Lien Auctions By Mail Online And Through Public Foreclosure Sales

Tax Lien Investing Simple Diy Investing For 18 Returns Diy Investing Investing Tax Preparation

Amazon Com Georgia Real Estate Tax Lien Investing For Beginners Secrets To Find Finance Buying Tax Deed Tax Lien Properties 9781951929091 Blank Greene Mahoney Brian Books

White County Tax Lien Sale Goes Online News Newsbug Info